Gen-Z, born between 1996 and 2010, is a generation deeply immersed in the world of beauty. This digitally-savvy cohort has been engaged with beauty from a young age, thanks to their easy access to influencer and celebrity-endorsed product lines and “Get Ready with Me” videos on platforms like TikTok and YouTube. Gen-Z’s willingness to experiment with makeup, skincare, and hair products sets them apart, with 45 percent trying new brands every two to three months, according to McKinsey’s 2023 global consumer survey. When brands resonate with Gen-Z, they enjoy impressive loyalty, making them a valuable demographic.

Gen-Z holds immense potential in shaping the beauty industry’s growth. By 2030, they will constitute a quarter of the world’s population, with an estimated income of $33 trillion, surpassing that of Millennials. Moreover, Gen-Z plays a significant role in influencing the purchasing decisions of older generations. Studies by the National Retail Federation, First Insight, and the University of Pennsylvania’s Wharton School show that Gen-Z substantially influences the buying choices of their parents.

However, Gen-Z is not a homogenous group; their preferences are in constant flux as they navigate the digital world and discover their identities. Understanding who Gen-Z is today and how quickly their preferences evolve is crucial for the beauty industry.

**Gen-Z Wants It All**

Gen-Z refuses to compromise. Unlike previous generations, they are uncompromising in their demands for brands, products, and marketing to align with their values, encompassing diverse gender, ethnicity, sexual orientation, and other aspects. Gen-Z expects brands to stand for important issues, including mental health and climate change, while embracing diversity.

Brands like Selena Gomez’s Rare Beauty create safe spaces for Gen-Z by openly discussing mental health and offering resources. Brands like Topicals and Eadem address specific skin issues faced by people of color, expanding conversations on skin tones.

McKinsey’s survey reveals that nearly 40 percent of Gen-Z prefers gender-neutral beauty products, a trend that larger brands like YSL Beauté are adapting to. Brands are also collaborating with male, transgender, and non-binary models for makeup products traditionally marketed to women. This approach aligns with Gen-Z’s values of authenticity and inclusivity.

To earn Gen-Z’s loyalty, brands must build authentic emotional connections.

**Prioritizing Value and Efficacy**

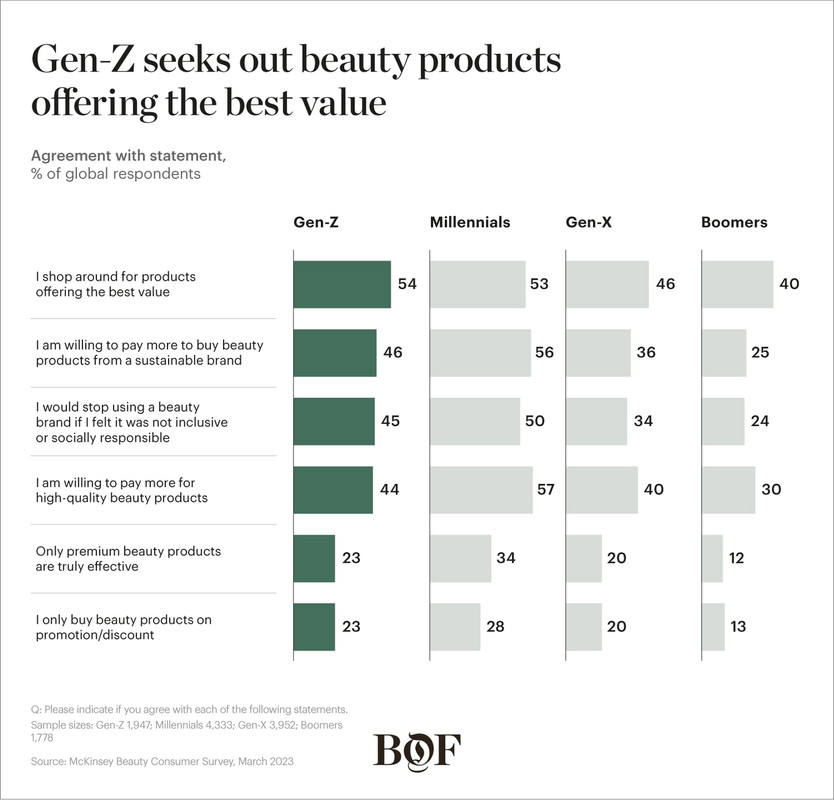

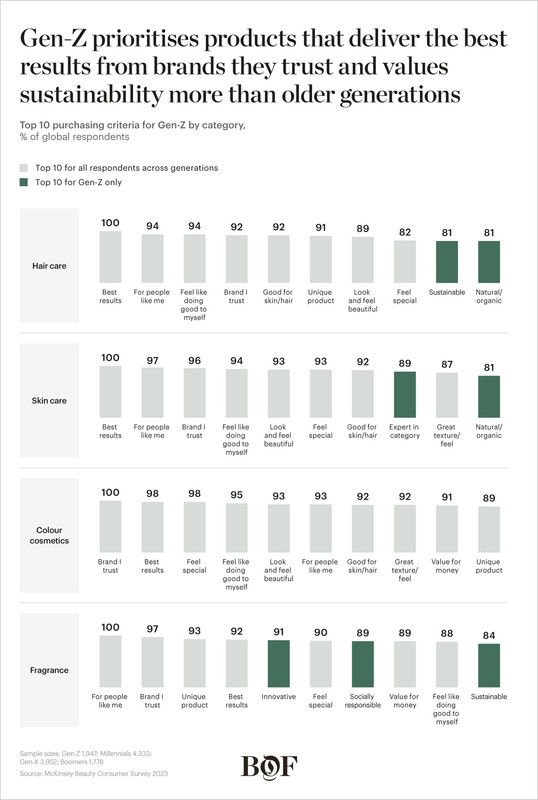

Similar to Millennials, nearly half of Gen-Z consumers meticulously research product ingredients and their benefits before making a purchase. However, Gen-Z does not equate higher prices with quality. They prioritize value for money and are more focused on product efficacy. Brands like The Ordinary appeal to younger shoppers by being transparent about ingredients and prices.

While Gen-Z contributes to the growth of the mass and masstige segments, premium brands can also succeed if they demonstrate additional value and sustainability. Almost half of Gen-Z consumers are willing to pay a premium for higher quality and sustainability, which may increase as their spending power grows.

**Being Real and In-Person**

Gen-Z values authenticity, unfiltered aesthetics, and realness. They seek relatability in brands and want to be part of a brand’s story. The term “community” carries great significance for Gen-Z.

Brands like E.l.f. involve Gen-Z in their brand story and prioritize authenticity in their marketing strategies. However, Gen-Z is not entirely reliant on digital platforms; they also value brick-and-mortar stores and prioritize high levels of service and pleasant store environments.

Retailers are adapting to cater to Gen-Z preferences. Staying connected with Gen-Z is vital for both brands and retailers, as this generation can inform pricing strategies, product lines, and marketing efforts. Brands must ensure their products carry meaning beyond their material value and be a force for positive change in how Gen-Z experiences beauty.